Basic Policy

1.Basic Concept

In order to meet the expectations and trust of all stakeholders, including shareholders, and to continuously improve corporate value, MonotaRO (hereinafter “the Company”) believes that it is important to conduct sound and transparent management while striving for agility and efficiency. Corporate governance is a mechanism to support such corporate activities of the Company and to ensure sound and transparent management while striving for agility and efficiency, and the Company will strive to strengthen and enhance its corporate governance.

2. Corporate Governance Structure

Corporate governance is the basic framework of corporate management in relation to various stakeholders. The Company’s stakeholders include shareholders, customers, employees, and business partners, and maximizing the interests of the shareholders is the Company’s most important responsibility. Corporate governance is an organizational structure to establish a system to ensure the validity, legality, and appropriateness of the content of disclosures regarding the Company's decision-making and business execution in order to maximize the interests of our shareholders and other stakeholders.

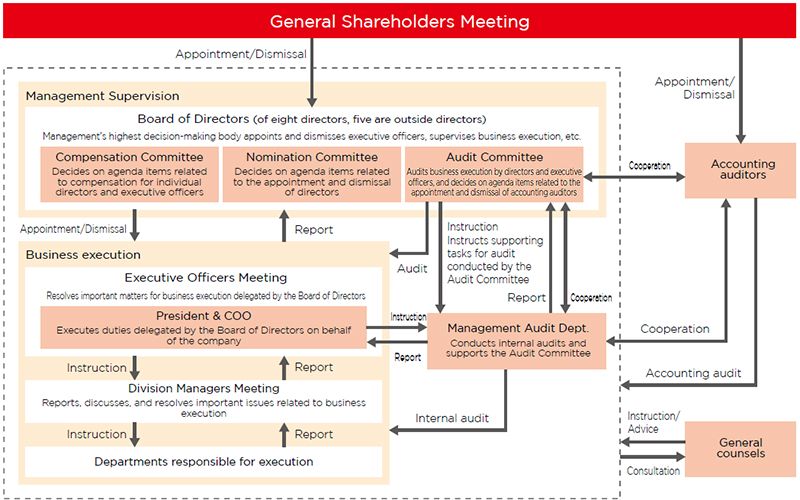

Based on this recognition, "separation of management supervision and business execution" is important for effective corporate governance, and based on the resolution of the Ordinary General Meeting of Shareholders held on March 29, 2006, the "Company with Committees" system (currently, the "Company with Nomation Committee" system) was adopted. In accordance with the transition to the Company with committees, three committees, the Nomation Committee, the Compensation Committee, and the Audit Committee, have been established.

As of March 2025, Board of Directors consists of nine directors, six of whom are independent outside directors. In addition, threeo of the four members of the NominationCommittee, three of the four members of the Compensation Committee, and all members of the Audit Committee are independent outside directors. The Nomination Committee determines proposals for the appointment and dismissal of directors, the Compensation Committee determines proposals for individual compensation of directors and executive officers, and the Audit Committee focuses on auditing the execution of duties by directors and executive officers and the decision-making process of the Board of Directors.

Based on this recognition, "separation of management supervision and business execution" is important for effective corporate governance, and based on the resolution of the Ordinary General Meeting of Shareholders held on March 29, 2006, the "Company with Committees" system (currently, the "Company with Nomation Committee" system) was adopted. In accordance with the transition to the Company with committees, three committees, the Nomation Committee, the Compensation Committee, and the Audit Committee, have been established.

As of March 2025, Board of Directors consists of nine directors, six of whom are independent outside directors. In addition, threeo of the four members of the NominationCommittee, three of the four members of the Compensation Committee, and all members of the Audit Committee are independent outside directors. The Nomination Committee determines proposals for the appointment and dismissal of directors, the Compensation Committee determines proposals for individual compensation of directors and executive officers, and the Audit Committee focuses on auditing the execution of duties by directors and executive officers and the decision-making process of the Board of Directors.

(1) Management Supervisory Function

Board of Directors

The Company is a company with a Nomination Committee. As the highest management decision-making body, the Board of Directors meets at least nine times a year to make decisions on important matters, mainly on matters of exclusive authority as stipulated in Article 416 of the Companies Act of Japan. The Board of Directors consists of nine directors, six of whom are outside directors. Outside directors include one attorney-at-law and one certified public accountant. The Company has established the following committees within the Board of Directors.

| Nomination Committee | This committee is a body that determines the content of proposals to be submitted to the General Meeting of Shareholders concerning the election and dismissal of directors, and is composed of four directors, including three outside directors. |

| Audit Committee | This committee meets once a month in principle to audit the appropriateness, legality, and appropriateness of the execution of duties by directors and executive officers, and to determine the details of proposals submitted to the General Meeting of Shareholders concerning the appointment and dismissal of accounting auditors. It consists of three outside directors, including one attorney-at-law and one certified public accountant. |

| Compensation Committee | This committee is composed of four Directors, including three Outside Directors, and determines the remuneration of Directors and Executive Officers on an individual basis in accordance with the Company's guidelines on remuneration. |

(2) Business Execution Function

Representative Executive Officers and Executive Officers

The Company appoints two Representative Executive Officers from the Executive Officers. The Representative Executive Officers represent the Company as the chief executive officers and execute duties delegated to them by the Board of Directors. The Representative Executive Officers are obligated to report and explain the status of business execution and monthly financial results to the Board of Directors once a month. The Executive Officers assist the Representative Executive Officers and are responsible for promoting and supervising the execution of business operations.

Board of Executive Officers

Consisting of Representative Executive Officers and Executive Officers, the Board of Executive Officers resolves important business execution matters delegated by the Board of Directors.

Division Managers' Meeting

Consisting of heads of divisions, this committee reports, discusses, and resolves important business execution matters.

3. Remuneration for Directors and Executive Officers

(1) Matters pertaining to the policy for determining the amount of remuneration, etc. for directors and executive officers or the method for calculating the amount of remuneration, etc.

To further promote the provision of services that enable customers to procure indirect materials more efficiently, inexpensively and less efforts, in accordance with our corporate philosophy "Transforming the materials procurement network," and to raise awareness of directors' and executive officers’ contributions to improving corporate performance and to increasing corporate value over the medium to long term, the Company has established the Executive Compensation Policy . The Executive Compensation Policy is outlined below.The details of individual remuneration, etc. of directors and executive officers for the current fiscal year are based on the results of thorough deliberations by the Compensation Committee, and the Compensation Committee has determined that they are in line with the Policy.

(2) Directors

In order to maintain independence and to monitor management separately from business execution, only fixed remuneration is paid to directors who do not concurrently serve as executive officers.

Compensation decisions are made by the Compensation Committee. In accordance with the Company's Compensation Committee rules, the director in question does not participate in the resolution regarding his or her own compensation.

Compensation decisions are made by the Compensation Committee. In accordance with the Company's Compensation Committee rules, the director in question does not participate in the resolution regarding his or her own compensation.

(3) Executive Officers

Basic Policies on Compensation

The Company designs and manages executive compensation based on the following five basic policies.

- ・The remuneration system should contribute to the Company's continuous growth and medium- to long-term improvement of corporate value and be consistent with the Company's corporate philosophy and code of conduct.

- ・The remuneration system should be highly performance-linked and strongly motivate the achievement of management strategies and corporate performance targets.

- ・The remunerations of directors and executive officers must reflect the Company's business performance and medium- to long-term initiatives.

- ・The remuneration system should share profits and risks with shareholders and raise awareness of the need to increase shareholder value.

- ・Objectivity, transparency, and fairness are ensured through the Compensation Committee's deliberation process to fulfill accountability to stakeholders.

Compensation Structure

Compensation for the Company's executive officers consists of monthly compensation and stock-based compensation. In order to ensure that the remuneration contributes to continuous growth and medium- to long-term improvement of corporate value, the following composition ratios have been established.

・Set the ratio of variable remuneration (performance-linked monthly remuneration and stock-based remuneration) to the annual remuneration amount in order to provide incentives to improve business performance and corporate value.

・Set appropriate compensation ratios for each position.

・Set the ratio of variable remuneration (performance-linked monthly remuneration and stock-based remuneration) to the annual remuneration amount in order to provide incentives to improve business performance and corporate value.

・Set appropriate compensation ratios for each position.

Monthly Remuneration

Monthly remuneration consists of fixed remuneration and performance-linked remuneration.

Fixed remuneration is paid to each executive officer for the role and responsibility he/she assumes, and is commensurate with his/her position and years in office, taking into consideration market standards and other factors.

The amount of performance-linked remuneration is determined based on the rate of achievement of the consolidated operating income plan and individual evaluation.

Fixed remuneration is paid to each executive officer for the role and responsibility he/she assumes, and is commensurate with his/her position and years in office, taking into consideration market standards and other factors.

The amount of performance-linked remuneration is determined based on the rate of achievement of the consolidated operating income plan and individual evaluation.

Stock-based Compensation

Stock-based compensation is positioned as an incentive to improve corporate value over the medium to long term and to raise awareness of value sharing with shareholders. The number of shares to be granted is determined based on the base amount based on the executive officer's position and the amount of growth in consolidated operating income.

It is designed to be granted once each year in the form of restricted stock, and to be exercisable after retirement.

It is designed to be granted once each year in the form of restricted stock, and to be exercisable after retirement.

Process for Determining Compensation

As a company with a Nomination Committee, the Compensation Committee determines the compensation of executive officers. The Compensation Committee consists of four directors, including three outside directors.

During the fiscal year of 2024, the Compensation Committee met six times resolved the amount of performance-linked compensation (bonus) to be paid based on the degree of achievement of business results and the amount of compensation.

During the fiscal year of 2024, the Compensation Committee met six times resolved the amount of performance-linked compensation (bonus) to be paid based on the degree of achievement of business results and the amount of compensation.

Return of Compensation, etc. (Mars Clause)

The Company may forfeit the stock-based compensation during the malus provision (forfeiture during the restricted period) in the event that the Compensation Committee determines that material revisions to the financial statements, material violations of the Company's internal rules, material damage to the Company's business or reputation, or material deficiencies in risk management or other events specified in the Company's rules have occurred.

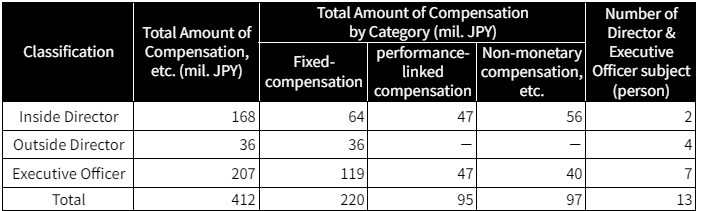

(4) Total amount of remuneration, etc. by director classification and by type of remuneration, etc. and number of directors and executive officers subject

(Note)

1. As of the end of the fiscal year of 2024, the Company had eight (8) directors, including five (5) outside directors, and six (6) executive officers. Two (2) of them serves concurrently as both a director and an executive officer and is included in the internal directors.

2. The performance indicator for performance-linked compensation is the percentage of achievement of the consolidated operating income plan, which for the fiscal year of 2024 was 37,066 million JPY (103.5% achievement rate) compared to the initial forecast of 35,820 million JPY. The reason for selecting this indicator is to provide an incentive to improve performance in a single year. The Company's performance-linked compensation is calculated by multiplying the base amount for each position by a payment ratio based on the results of company performance evaluation and individual evaluation.

3. Non-monetary compensation consists of 103 million JPY in restricted stock, and the conditions for allotment in restricted stock are as described in "Stock-based Compensation" above.

4. By resolution of the Compensation Committee held on January 12, 2018, the Company abolished the retirement benefit system for directors and corporate auditors, but the amount accumulated through 2017 will be paid upon retirement. Based on this, in addition to the above, retirement benefits of 10 mil. JPY was paid to two (2) executive officers who retired during fiscal year of 2024.

1. As of the end of the fiscal year of 2024, the Company had eight (8) directors, including five (5) outside directors, and six (6) executive officers. Two (2) of them serves concurrently as both a director and an executive officer and is included in the internal directors.

2. The performance indicator for performance-linked compensation is the percentage of achievement of the consolidated operating income plan, which for the fiscal year of 2024 was 37,066 million JPY (103.5% achievement rate) compared to the initial forecast of 35,820 million JPY. The reason for selecting this indicator is to provide an incentive to improve performance in a single year. The Company's performance-linked compensation is calculated by multiplying the base amount for each position by a payment ratio based on the results of company performance evaluation and individual evaluation.

3. Non-monetary compensation consists of 103 million JPY in restricted stock, and the conditions for allotment in restricted stock are as described in "Stock-based Compensation" above.

4. By resolution of the Compensation Committee held on January 12, 2018, the Company abolished the retirement benefit system for directors and corporate auditors, but the amount accumulated through 2017 will be paid upon retirement. Based on this, in addition to the above, retirement benefits of 10 mil. JPY was paid to two (2) executive officers who retired during fiscal year of 2024.

■Composition of the Board of Directors and Committees and their Attendance in 2024

* As of December 31, 2024.

* As of December 31, 2024.

Name |

Classification |

Position |

Board of Directors |

Compen- sation Committee |

Audit Committee |

Nomination Committee |

| Masaya Suzuki |

Director, Chairperson and CEO |

Compensation Committee Member |

13/13 |

4/4 |

ー |

ー |

| Sakuya Tamura |

Director, President, and COO |

ー |

11/11 |

ー |

ー |

ー |

| Masahiro Kishida |

Outside Director |

Nomination Committee Chairperson, Compensation Committee Member |

12/12 |

6/6 |

ー |

2/2 |

| Tomoko Ise |

Outside Director |

Audit Committee Chairperson, Nomination Committee Member |

12/12 |

ー |

19/19 |

2/2 |

| Mari Sagiya |

Outside Director |

Compensation Committee Chairperson |

12/12 |

6/6 |

3/3 |

1/1 |

| Hiroshi Miura |

Outside Director |

Audit Committee Member |

11/12 |

ー |

19/19 |

1/1 |

| Kiyoshi Nakashima |

Outside Director |

Audit Committee Member |

10/10 |

ー |

16/16 |

ー |

| Barry Greenhouse |

Director |

Nomination Committee Member |

13/13 |

ー |

ー |

2/2 |